The contemporary art market accounted for $1.89 billion in 2023/2024. Works priced under $5,000 represented 82% of all contemporary art sales during the period.

This is confirmed by the 29th annual report on the contemporary art market published by Artprice by Artmarket.

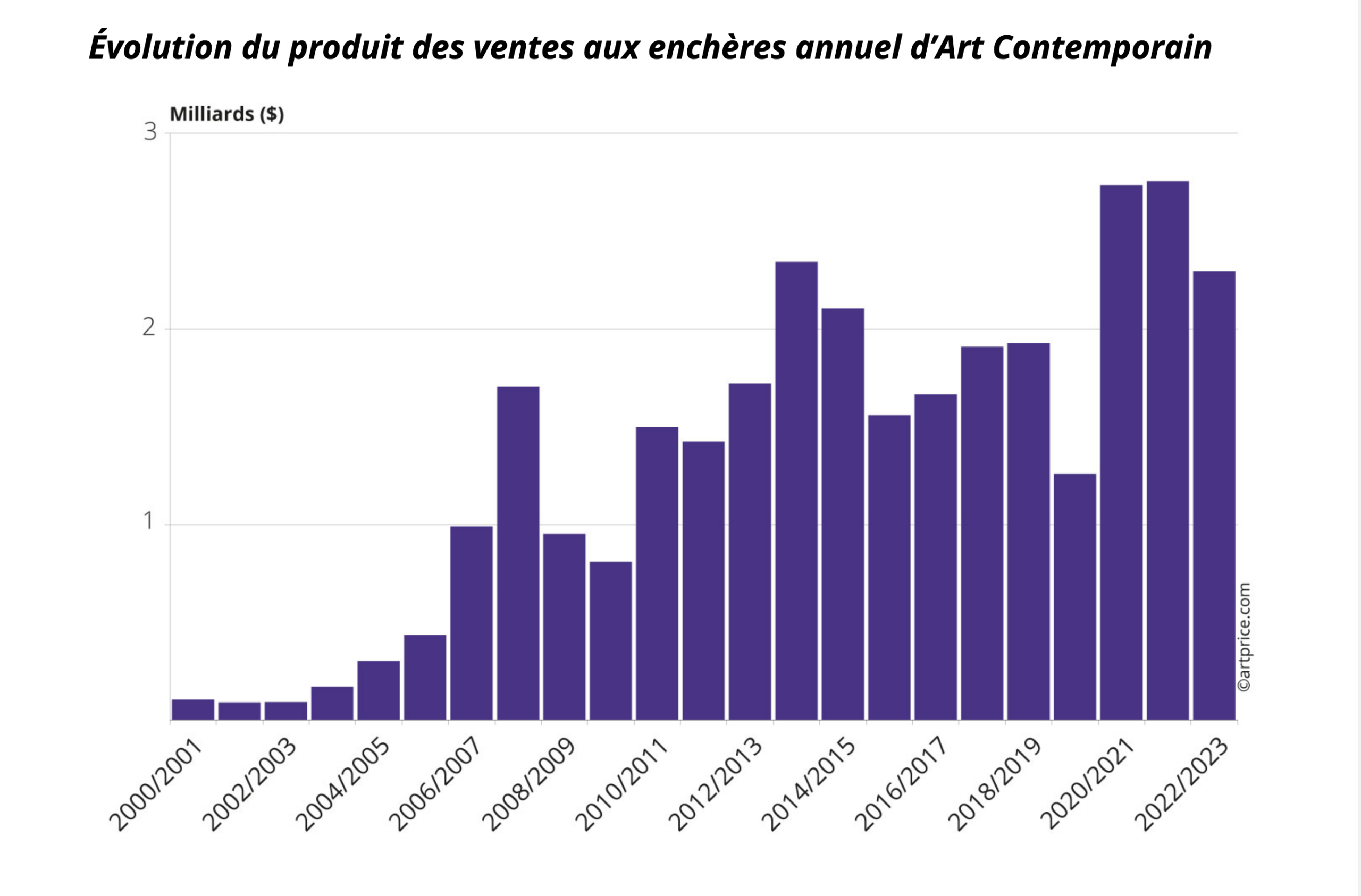

Thierry Ehrmann, the founder of Artprice and CEO of Artmarket.com, stated on ActusNews: “The Contemporary Art Market is no longer what it was in 2000. It has undergone profound structural changes, experiencing a revenue growth of +1800%, with an increasing number of contemporary artists being sold at auction (5,400 artists in 2000 compared to nearly 33,072 in the 2023/2024 period) and an exponential rise in the number of artworks sold (12,000 lots in 2000 versus 132,380 today). It has expanded geographically, growing from 39 to 61 countries actively participating in auctions. This growth has been accelerated by the Internet and the ease of remote transactions, making it the most dynamic and profitable segment of the 21st-century art market.”

Contemporary art is thus not only a tangible asset but also an opportunity to surround oneself with beauty and emotion every day.

A Growing Contemporary Art Market: Financial and Cultural Asset.

Over the past twenty years, the economic value of contemporary art has experienced a remarkable surge, rising from $169 million to $1.888 billion. This sector has established itself as a pillar of the global art market, now accounting for 18% of its total value, compared to just 3% at the beginning of the century.

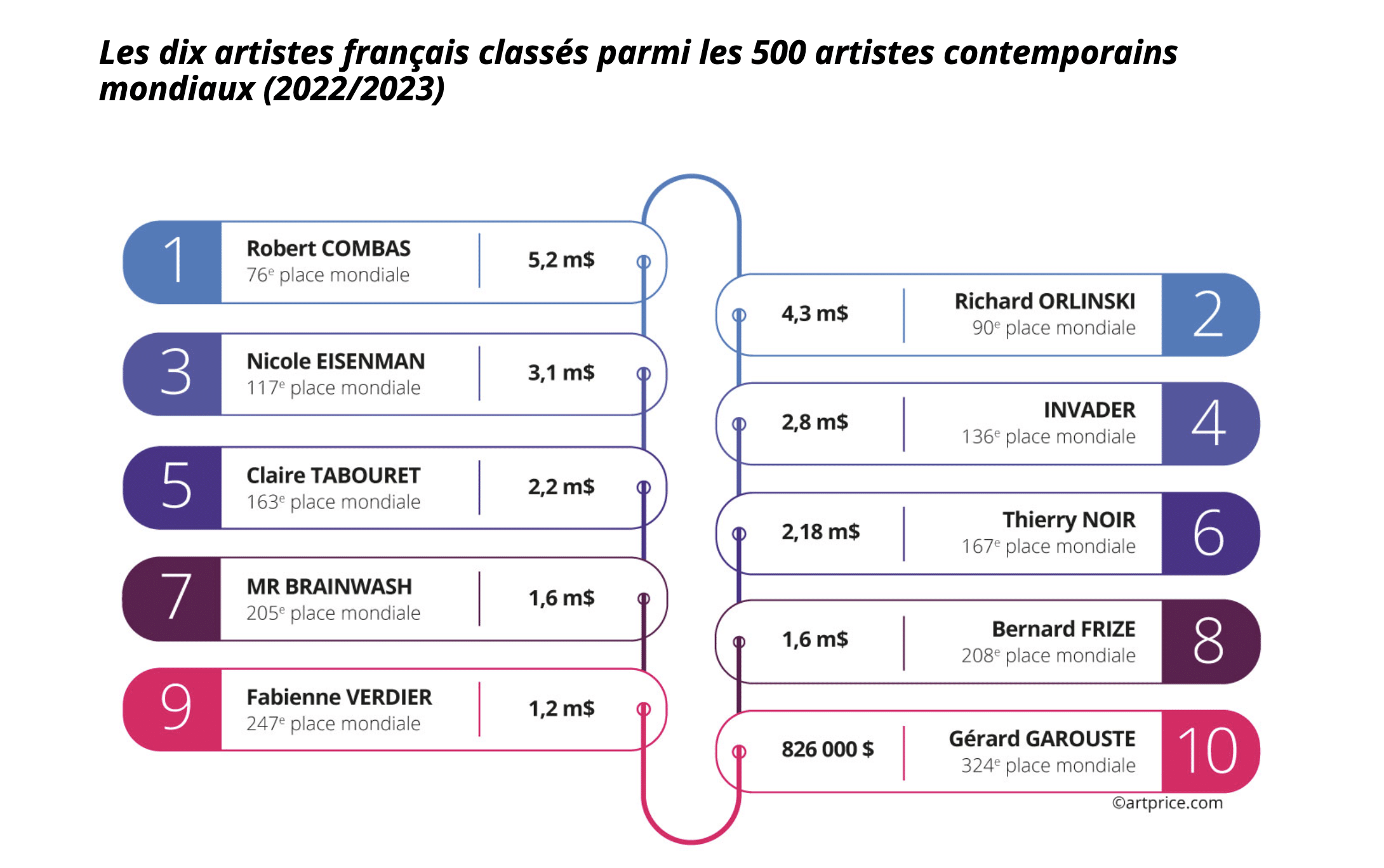

The French contemporary art market, imbued with a cultural passion for art, stands out for its spirit of discovery and a strong collecting dynamic among its buyers. France accounts for 8% of global transactions, making it the third most active player, behind the American and British giants. Moreover, ten French artists are present among the world's top 500.

Contemporary art illuminates our interiors with passion, depth, and emotion.

Contemporary art is thus a safe haven for investing and building wealth, but it offers much more than that. Acquiring artworks provides the ability to secure funds and grow one’s assets while enjoying the joy and emotion these pieces bring to our daily lives, something a purely financial investment cannot offer. Artworks bring a unique magic to our interiors that only art can provide. Interest in contemporary art is therefore growing, both in private collections and public spaces. The works of artists such as Georges Pelletier, Caroline Rennequin, or Natalie Rich are integrated into iconic and prestigious locations, including the Chanel boutique on Fifth Avenue in New York, the 5-star Six Senses Ibiza hotel, the Élysée Palace, the Byblos Hotel in Saint-Tropez, and the renowned Teranka Hotel on the island of Formentera.

Supporting artists and their market value while diversifying your assets.

Collectors who support artists enable them to develop their artistic vision and amplify the reach of their work. This contributes to an increase in the artists’ market value, alongside other factors such as international exhibitions, press coverage, and inclusion in prestigious collections. For example, in 2016, a 160 cm white-glazed Totem by Georges Pelletier was valued at €2,900 in the European market. By 2025, the price of this piece has risen to a minimum of €9,500 in Europe and is sold for €11,800 in the American market.

His works have been exhibited at the Consortium, sold in New York, Los Angeles, and Ibiza through renowned galleries, integrated into remarkable private and public collections, and featured in numerous press publications, all of which have significantly boosted his market value over 10 years (+227%).

Another example is the huge rise of painter Caroline Rennequin, whose 75 cm x 55 cm painting was valued at €2,400 in 2022 and is now worth €5,400, a 125% increase in just three years. Her works have been exhibited at prestigious places such as the Jean Fournier Gallery in Paris, Collectible New York in September 2024, Galeria Tambien Ibiza, and the Passe Simple Vintage Gallery in Knokke, where her solo shows were great successes. Additionally, her pieces have been featured at Private Choice Paris and included in numerous prestigious collections across Europe and the United States.